There’s always that one financially savvy person who seems to have it all together:

Money for a relaxing vacation? No sweat. Emergency savings fund? Of course. Believe it or not, you can also develop similar mottos of mindfulness to become more like these purple unicorns… Or, as I like to call them – financially effective consumers!

1. Waste Not, Want Not

Financially savvy consumers know the best ways to get the most out of certain products and services. Whether it consists of repurposing leftovers, extreme couponing, or using a free trial – they waste nothing. For example, did you know that 22% of coupon enthusiasts make over $100,000 per year? In fact, there are more coupon-cutters at this income level than any other.

Smart shoppers like these tend to pounce on unique opportunities to get what they want. By using things others may see as minor, undesirable, or annoying junk, they improve their lives without being impulsive or wasteful. These consumers know that wasting discounted or free services and products equal wasted money.

Making small changes like taking leftovers for lunch every day, using cashback deals when purchasing on credit, or going to a preferred ATM to avoid fees, reusing things that would normally be thrown away, or looking through mailers for coupons and specials can maximize the return on even the simplest daily routines.

Word to the wise: Don’t go crazy with this tip… Financially effective people resist becoming loose spenders by using only what they need or already have.

2. Don’t put all your eggs in one basket

Foolish investments, gambling, harebrained schemes, living paycheck-to-paycheck… These are all certain paths to failure which financially astute people avoid like the plague.

Financially effective people wouldn’t be caught dead relying on uncertainties by taking irrational risks like these. In fact, they often seek out diversified ways of creating and maintaining different sources of income. Whether it’s through financial advising, capitalizing on a lucrative hobby, self-education, or goal-mapping, it’s always a good idea to create two plans: one for making money, and the other for saving it.

Want to save up for a big purchase while continuing to pay your bills? Start budgeting and separating your accounts by basic needs, desires, and goals. One account for a downpayment on a car or home, another for monthly bills, emergency/medical funds, food, entertainment, and so on.

Compartmentalizing your accounts according to multiple goals is the easiest way to start doing this today. Determine where you spend the most and what gives you the most income, and how you can add more money to your income. Many banks now offer free online account features that show where your money is frequently being spent. You can even use cell phone apps to help you manage your money correctly and see your biggest cash flow categories. Starting a side gig or learning a new skill can help you rake in the cash too.

Let’s be clear, risk-taking isn’t always inherently a bad thing, especially when it comes to specific financial choices like investing. Throwing half of your savings into that hot new tech startup or the Powerball isn’t the brightest idea. As for those who choose to throw all their money at activities with unrealistic returns: don’t expect a bailout unless you can magically morph into a bank.

3. Every cloud has a silver lining

We are constantly reminded to stay positive in various aspects of life, particularly in the face of adversity.

The savvy ones among us extend this mantra to their personal finances as well. Staying resilient when battling an obstacle or financial setback is key to recovering and improving. Wallowing in despair, brooding on the silly mistake or unforeseen misfortune that caused a break in their stride doesn’t rattle these types for long – and it shouldn’t.

Take the 2015 Planning and Progress Study for example. In it, Northwestern Mutual found that 59% of Millennials “expect their financial situation to improve this year”. This reflects much more positivity when compared with only 41% of the general public who agree.

However you may feel about the details, Millennials have had a challenging time since the 2008 financial crisis. They’ve experienced everything from competitive yet scarce job opportunities (even among the highly educated), saddled with heavy student loan debt and ruthless lenders, to markedly reduced incomes compared to their parents, and lower rates of homeownership. They are even postponing meaningful relationships (like children and marriage) due to all of the above. Although they have an uphill battle ahead of them, this shows how many Millennials are extremely optimistic. How in the world do they stay so positive?

That cheerful confidence of theirs is linked to resilience, which is key to achieving long-term goals. Despite the hopelessness, anxiety, and fear many Americans feel towards their current finances, there is always a silver lining or a way to create one yourself. No, it won’t always come naturally, but financially effective people know their obstacles are temporary no matter how seemingly insurmountable. Your financial fate is within your own control.

Focus on the valuable points and lessons you’re learning. This will not only help you out of a rut, it will also drive the fulfillment of your future plans. The next time you feel frustration creep in, take a tip from the youngsters for a change and shrug it off.

4. Actions Speak Louder Than Words

Trust is gained when we see someone’s words align with their actions over time. While it’s easy to dismiss, this is really no difference whether you have people who rely on you financially or if you live solo. Ultimately, financially-effective people trust in their ability to improve by making a real, disciplined effort.

For instance, on New Year’s Eve, 45% of Americans make resolutions they really want to keep (and 34% of those are related to money). Yet, only 8% actually achieve their goals!

So what is it that these folks in the 8% minority have in common? The simple act of making an explicit New Year’s Resolution boosts the likelihood of achieving it tenfold. But, that’s not all it takes. Behavioral scientists – including Dr. John Norcross of the University of Scranton – found the following three things all contribute to successfully reaching your goals:

- Readiness to change. How prepared and willing are you to do what’s necessary?

- Using helpful behavioral strategies. Stick to it, keep yourself accountable, and take steps to reduce your encounters with tempting distractions.

- Successfully overcoming setbacks. You will be disappointed, have emergencies, and possibly make mistakes while you’re trying to change. Concentrate on your end goal, how happy you will feel when reaching it, and what you need to pull through.

Maintaining milestones, setting up rewards when reaching those milestones, and avoiding risky behaviors while going for the gold motivate these types to act on financial improvement instead of just talking about it. So what’s the key to embarking on a change in the first place? The secret is self-efficacy, ( which is believing in your personal ability to create and maintain the change you desire).

5. A Penny Saved Is A Penny Earned

Little things add up. I’m sure you’ve heard that one before.

Many of us try to follow this but those who are in-tune with their money practice this daily. There is even a popular challenge built around this old adage. The results? You can end up with hundreds of dollars’ worth of savings if you’re consistent!

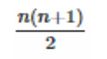

That’s right, taking time every day to store pennies that would otherwise languish at the bottom of your wallet can net you a solid return. Saving 1 penny on the first day, 2 on the second day, and so on for an entire year can generate a pleasantly surprising wad of cash. Here’s the formula that explains the math:

Replace “n” in this formula with 365, and then divide the result by 100. For example, take the following formula, 365($0.01+3.65) divide by 2, and then divide by 100 (since there are 100 pennies in one dollar). The potential annual savings equals $667.95 – or, $671.61 if it’s a leap year.

If you really want to test your financial effectiveness, use this trick with quarters ($0.25) or even dollars ($1.00) instead of pennies and watch your savings grow!

Wrapping Up

Who says a leopard can’t change its spots? Following in the footsteps of these money-saving superstars can make you just as consistent and secure.

To start getting the most out of your money, incorporate these techniques into your life by preparing with the right state of mind. Remember, there is no better time than now to start being financially effective!

How to Land the Best-Paying Virtual Jobs of 2017

How to Land the Best-Paying Virtual Jobs of 2017 Top Scholarships For Baby Boomer College Students

Top Scholarships For Baby Boomer College Students 6 Sneaky Insider Secrets That Will Slash Your Monthly Bills

6 Sneaky Insider Secrets That Will Slash Your Monthly Bills