Feeling completely overwhelmed about your finances?

Paralyzed by major money decisions?

Wondering why you can’t make progress?

Poor financial planning causing you feelings of shame or humiliation?

Excessive, fearful worry over your finances can bring out some really unpleasant emotions, and it can be quite a scary thing.

Stressing about how you’re going to get some much-needed funds to cover an emergency – even if you’ve already been saving? Are you convinced you’re going to be forced to live in poverty after retirement?

What Financial Fear Looks Like

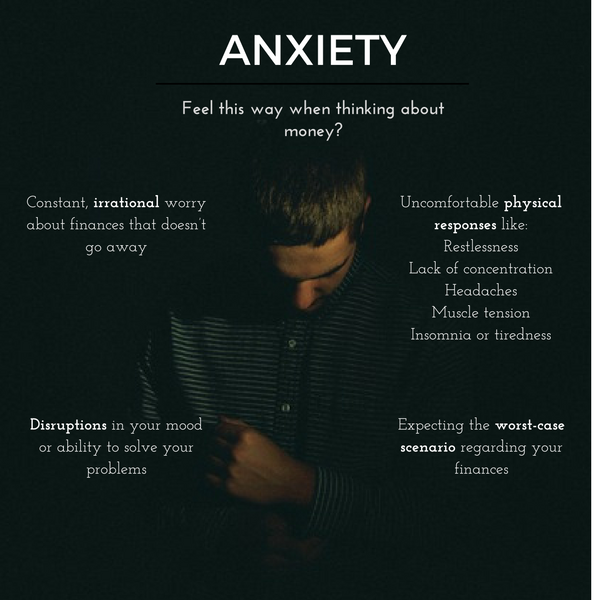

Whatever the reasons for your financial fears, there’s no need to keep indulging in an unhealthy pattern of thinking. So how can you identify when these thoughts are just too negative, becoming more of an obstacle to success rather than a motivator of it? Let’s see what it looks like when financial fears are encouraged by anxiety.

Anxiety is a huge motivation-killer and can take many forms. From any of the emotions listed above to manifestations of actual physical pain, fretting about money can take a brutal toll on your health, but it doesn’t have to disrupt your peace of mind.

Want to stop feeling stuck and out of control when it comes to your money? Try using these tips to combat the most common financial fears in America.

American Nightmares

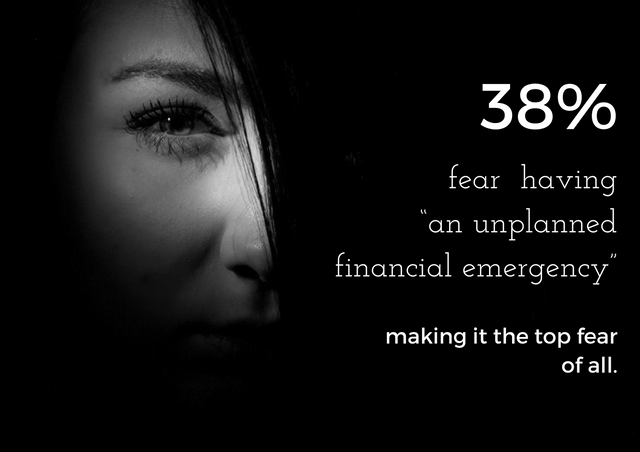

This year’s Northwestern Mutual Planning and Progress Study reveals some of the worst fears Americans have about their finances. After studying over 2,600 adults, at least some of your own concerns are probably reflected in these key takeaways as well.

Financial Fear #1: Unplanned Emergencies

That’s just a little vague. Aren’t all emergencies essentially ‘unplanned’? After digging a bit deeper, it becomes clear which sudden financial emergencies most people fear:

“When asked specifically where people’s financial anxiety is coming from, ‘unexpected expenses’ (55%) received the most mentions. This came well ahead of expected and generally planned-for major financial events such as saving for retirement (29%), healthcare costs (27%), mortgage/rent expenses (25%), credit card debt (25%), and student loan debt (13%).”

– Northwestern Mutual’s 2016 Planning and Progress Study

When you start fearing unanticipated expenses more than the potentially devastating impacts of, say, losing a job, long-term unemployment, or outliving retirement savings (as noted within this study), that typically means one of two things:

- You haven’t saved enough in your emergency funds to cover an unforeseen expense or don’t even have a plan. In this case, your fear is actually rational (but still unhealthy).

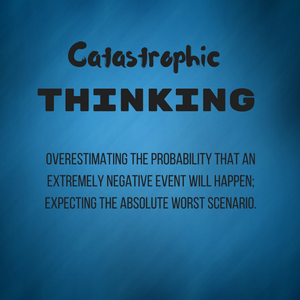

- You do have money saved or are implementing a plan to cover unforeseen expenses. A more irrational anxiety has taken over, and you’re likely doing what’s known as “catastrophic thinking.”

How to Conquer It

If you want to calm your anxieties, remember to maintain strong control both financially and mentally. Become comfortable with your feelings surrounding your finances – how you manage, speak, and think about them in the present will determine the future. Even if you have to deal with a costly unexpected expense, use these tips to stay collected:

- Mindfulness is the act of staying present in the moment. Practice noticing new things and being grateful in order to relax. This helps clear your mind and lower anxiety by focusing only on the current situation without negative judgments or expectations. It also helps with ultimately making better decisions.

- Try being practical and facing your fear. Calculate the largest potential cost of the financial crisis keeping you up at night and work towards putting at least half of it into an emergency fund. Find or create a second source of income. Set up an automated emergency savings schedule. Have someone hold you accountable for staying consistent. Instead of that unnecessary purchase, route the money to your fund. You can never be perfect, but you can be well-prepared.

- Reward positive behavior. Tend to put off adding to your emergency fund? Make a pact of reciprocity with yourself. For example, treat yourself to a mini-gift, favorite food, or something you like after reaching a savings milestone.

Financial Fear #2: Medical Expenses

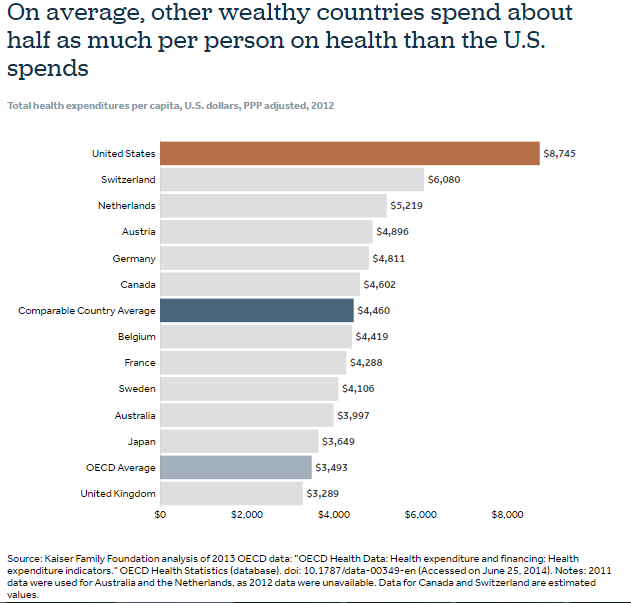

Your health is your most precious asset, the one thing that can truly be devastating to your life if it declines. Not only is your health crucial to your quality of life, but in comparison to other wealthy nations, Americans spend more money on healthcare.

Factoring in politics and the growing burden of chronic disease in the United States, expenses won’t get lower for quite some time. So, is it really any wonder so many people fear being financially wiped out by an illness?

How to Conquer It

A full 67% of adults surveyed say their financial anxiety is “negatively impacting their health”, and this includes the 34% who already fear a fiscally-damaging medical crisis.

It doesn’t take rocket science to determine that this unhealthy anxiety could easily become a self-fulfilling prophecy. Here are some ways to keep your mind free of worrying about a potential health scare that could turn into a real-life chainsaw massacre on your money:

- Pay attention to your health. This may seem obvious, but you wouldn’t believe how many people neglect their physical and mental health due to work, family, general forgetfulness, stress, and other reasons. All the excuses in the world aren’t good enough when it comes to enjoying a better quality of life free of largely preventable ailments. If you must, create a strict exercise, rest, and nutrition plan, complete with email or phone reminders but don’t dismiss your own needs if you want to avoid high medical bills.

- Keep calm, employed, and meditate. Repeated widespread research on Americans has shown that experiencing financial stress or even just the awareness of economic instabilities – like unemployment – can wreck your health. Such anxiety is linked to physical pain, reduced pain tolerance, and increased use of over-the-counter painkillers. It’s a good idea to not only practice mindfulness as mentioned above, but advanced breathing techniques when you feel overwhelmed at the hefty price of healthcare. Meditation also can be done while reclining or sitting still with relaxing music, (preferably instrumental without the distraction of lyrics).

- Maintain your medical records. This is especially important if you tend to visit multiple doctors, are recommended a medical procedure, or change your health insurance. You won’t have to recall your test results from months ago when a new physician asks, and you can pick up on any patterns that may go unnoticed before they become a serious issue.

Wrapping Up

Financial uncertainty can be scary sometimes. Uneasiness can quickly turn into anxiety. The good news is that you can control your anxiety through preparation and actively staying in the moment instead of worrying about the future for which you’ve prepared.

Did you recognize any of these financial fears in your own thought process? Perhaps you have apprehensions or even some tips not listed here? Please share in the comments!

How to Choose the Right Home Improvement Contractor

How to Choose the Right Home Improvement Contractor Insurance Scores: What It Is (& When You Should Actually Worry)

Insurance Scores: What It Is (& When You Should Actually Worry) 4 Ways to Save on Your Smartphone Bill

4 Ways to Save on Your Smartphone Bill